Writing calls is a straight forward options strategy. When you write a call, you receive cash upfront and, in most cases, hope that the option is never exercised. It can be conservative or risky, depending on whether you’re covered or uncovered.

CALCULATING RETURN

To calculate the return on a written call, you’ll have to take into account the transaction costs and brokerage fees you pay for opening the position, which will be deducted from the premium you receive. And if your option is exercised, you’ll have to pay another round of fees. But since you probably plan for your option to expire unexercised, if you’re successful you won’t face any exit transaction fees or commission. If you write a call on a stock you hold in a margin account, you should consider the margin requirement imposed by your firm when calculating return. If your trade is successful, you retain all your capital, but it will be tied up in the margin account until expiration. That means you can’t invest it elsewhere in the meantime.

TRADER OBJECTIVES

You might write calls to receive short-term income from the premium you’ll be paid. If that’s your strategy, you anticipate that the option you write will expire out-of-the-money and won’t be exercised. In that case, you’ll retain all the premium as profit. If you’ve written this call on stocks you already own, known as a covered call, the premium can act as a virtual dividend that you receive on your assets. Many Traders use this strategy to earn additional income on non-dividend-paying stocks. Alternately, you could view the premium to reduce your cost basis, or the amount that you paid for each share of stock.

EXITING AND EXERCISE

If the stock or other equity on which you wrote a call begins to move in the opposite direction from what you anticipated, you can close out your position by buying a call in the same series as the one you sold. The premium you pay may be more or less than the premium you received, depending on the call’s intrinsic value and the time left until expiration, among other factors. You can also close out your position and then write new calls with a later expiration, a strategy known as rolling out. If the call you wrote is exercised, you will have to deliver the underlying security to your brokerage firm.

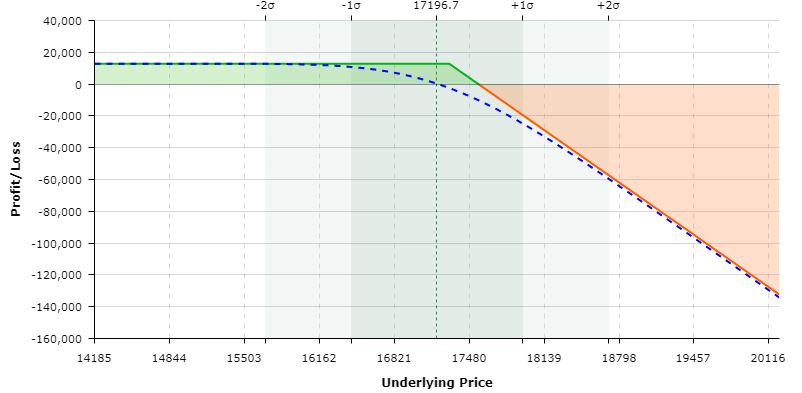

PAY OF CHART

Whenever someone buys a call option, there is someone on the other side, who has sold that call option. If the maximum loss for a long call position is equal to the premium paid, it automatically means that the maximum gain for the short call position will be equal to the premium received. Similarly, if the maximum gain for the long call position is unlimited, then even maximum loss for the short call position has to be unlimited (theoretically). Lastly, whenever, the long call position is making losses, the short call position will make profits and vice versa. Hence, if we have understood long call pay-off, short call pay-off-chart will be just the water image of the long call pay-off. Thus at 17,100 Nifty, when long call position makes a loss of Rs. 262.35, short call position will make a profit of Rs. 262.35. Similarly for 17700, when a long call makes a profit of 137.65, the short call position will lose 137.65. As Nifty starts rising, the short call position will go deeper into losses.

| Nifty at Expiry | Premium Paid | Buy Nifty at | Sell Nifty at | Pay off for Long Call Position | Pay off for Short Call Position |

|---|---|---|---|---|---|

| A | B | C | D=A+B+C | - D | |

| 17100 | -262.35 | -17100 | 17100 | -262.35 | 262.35 |

| 17150 | -262.35 | -17150 | 17150 | -262.35 | 262.35 |

| 17200 | -262.35 | -17200 | 17200 | -262.35 | 262.35 |

| 17250 | -262.35 | -17250 | 17250 | -262.35 | 262.35 |

| 17300 | -262.35 | -17300 | 17300 | -262.35 | 262.35 |

| 17350 | -262.35 | -17300 | 17350 | -212.35 | 212.35 |

| 17400 | -262.35 | -17300 | 17400 | -162.35 | 162.35 |

| 17450 | -262.35 | -17300 | 17450 | -112.35 | 112.35 |

| 17500 | -262.35 | -17300 | 17500 | -62.35 | 62.35 |

| 17550 | -262.35 | -17300 | 17550 | -12.35 | 12.35 |

| 17600 | -262.35 | -17300 | 17600 | 37.65 | -37.65 |

| 17650 | -262.35 | -17300 | 17650 | 87.65 | -87.65 |

| 17700 | -262.35 | -17300 | 17700 | 137.65 | -137.65 |

The pay-off chart for a short call position is given. Maximum gain for an option seller, as explained earlier, will be equal to the premium received (as long as Nifty stays below strike price) whereas maximum loss can be unlimited (when Nifty starts moving above BEP). BEP for a short call position will also be equal to X + P. BEP is independent of position (long or short), it is instrument-specific (call option).

The contract value for a Nifty option with a lot size of 50 and strike price of 17300 is 50 * 17200 = 8,56,000.

Premium is received by the seller of the option. However, he has to pay the margin. This is because the option seller has an obligation and since his losses can be unlimited, he can be a potential risk for the stability of the system.

Covered Calls

Writing covered calls is a popular options strategy. If you buy shares at the same time that you write calls on them, the transaction is known as a buy-write. If you write calls on shares you already hold, it is sometimes called an overwrite. This strategy combines the benefits of stock ownership and options trading, and each aspect provides some risk protection for the other. If you write a covered call, you retain your shareholder rights, which means you’ll receive dividends and be able to vote on the company’s direction. Writing covered calls is a way to receive additional income from stocks you already own. It can also offer limited downside protection against unrealized gains on stocks you’ve held for some time since you lock in a price at which to sell the stock, should the option be exercised. You should realize, however, that if a stock on which you’ve written a covered call rises in value, there’s a very real chance that your option will be exercised, and you’ll have to turn over your shares, missing out on potential gains above the strike price of your option.

When you write a covered call, you own the stock. For example, say you purchased 100 shares of ABC stock at Rs. 50.

100 shares x Rs. 50 per share

= Rs. 5,000 Investment

You write a 55 call on the stock and receive a Rs. 300 premium or Rs. 3 for each share covered by this contract.

That means that the Rs. 50 you paid for each share is offset by the Rs. 3 you received, so your net price paid is Rs. 47 per share.

Rs. 5,000– Rs. 300

= Rs. 4,700 or Rs. 47 per share

Even if the option is exercised, you’ll receive Rs. 55 per share, which is a profit of Rs. 8 per share, or Rs. 800.

Rs. 5,500– Rs. 4,700

= Rs. 800 Profit

However, if the stock price rises significantly above Rs. 55, you won’t share in that gain.

Naked Calls

A much riskier strategy is writing naked calls, or stock options you don’t own. Also known as uncovered call writing, this strategy appeals to bearish Traders who want to capitalize on a decline in the underlying shares.

You write a 55 call on a stock and receive a Rs. 300 premium or Rs. 3 for each share covered by this contract.

If the price doesn’t go up and the option expires unexercised, you keep the Rs. 300 premium as profit.

If the stock price goes up to Rs. 59 and the 55 call is exercised, you receive Rs. 55 a share or Rs. 5,500. But you’ll have to buy the stock at market price, or Rs. 5,900. The premium reduces your Rs. 400 loss to Rs. 100.

Rs. 5,900 Purchase – Rs. 5,500 Exercise

= Rs. 400 – Rs. 300 Premium

= Rs. 100 Net loss

While this loss is moderate, every additional dollar that the stock price increases means your loss increases

by Rs. 100—and there’s no limit to how high your loss could climb.

If you choose this strategy, you’ll have to keep the minimum cash margin requirement in your margin account, to cover the possibly steep losses you face if the option is exercised. If you are assigned, you must purchase the underlying stock to deliver it and fulfill your obligation under the contract.