Don’t diversify with too little money. There is no reason to diversify your portfolio if you only have a small fortune. If you want to become rich, you must first be focused. Look at the top richest people in the world. These people became rich, not by being diversified, but by being focused. Don’t do what the poor and middle-class do, which is to put their few eggs in too many baskets. Instead, focus, and put them in a few ones. Aim to get a yield that will have an impact on your life and go for diversification as soon as you’ve acquired wealth that will be tough to earn back through your daily job.

NEED FOR FINANCIAL LITERACY

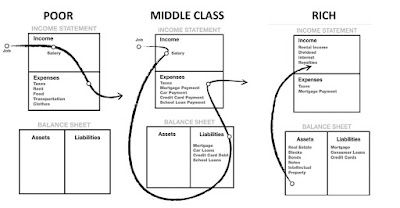

The main problem with today’s schooling system is they don’t teach the student about personal finance. Their main source of personal finance lessons is from their parent who is actually financial illiterate and poor. Money is a form of power. Even more powerful though, is financial education. Money without financial intelligence is money soon gone.

Even though after winning a lottery, poor people will automatically go back to their previous state or plummet to a worse state. This is due to the lack of personal literacy. They tend to buy up more liability than an asset.

There are 4 parts of financial literacy that you should focus on, according to Robert Kiyosaki.

1. Accounting: Accounting is the ability to read numbers read – be it numbers from an annual report, or from your personal bank account.

2. Investing: This is the science of money making money.

3. Understanding the markets: At least, you should understand the basic rules of supply and demand.

4. Law: Understanding the tax advantages and personal protection provided by corporations

Don’t be afraid to spend your money on education that will improve your knowledge and develop the skills necessary to beat your weaknesses.

Don’t work for money. Make money work for you.BUILD YOUR ASSET!